Ramp

via Ashby

Transaction Monitoring & Sanctions Screening Program Manager

Compensation

$100K - 150K a year

Responsibilities

Manage and improve transaction monitoring and sanctions screening systems, including governance, tuning, documentation, and audit preparation.

Requirements

6+ years in AML/BSA compliance or financial crime systems, strong regulatory knowledge, SQL proficiency, and experience collaborating with engineering and data science teams.

Full Description

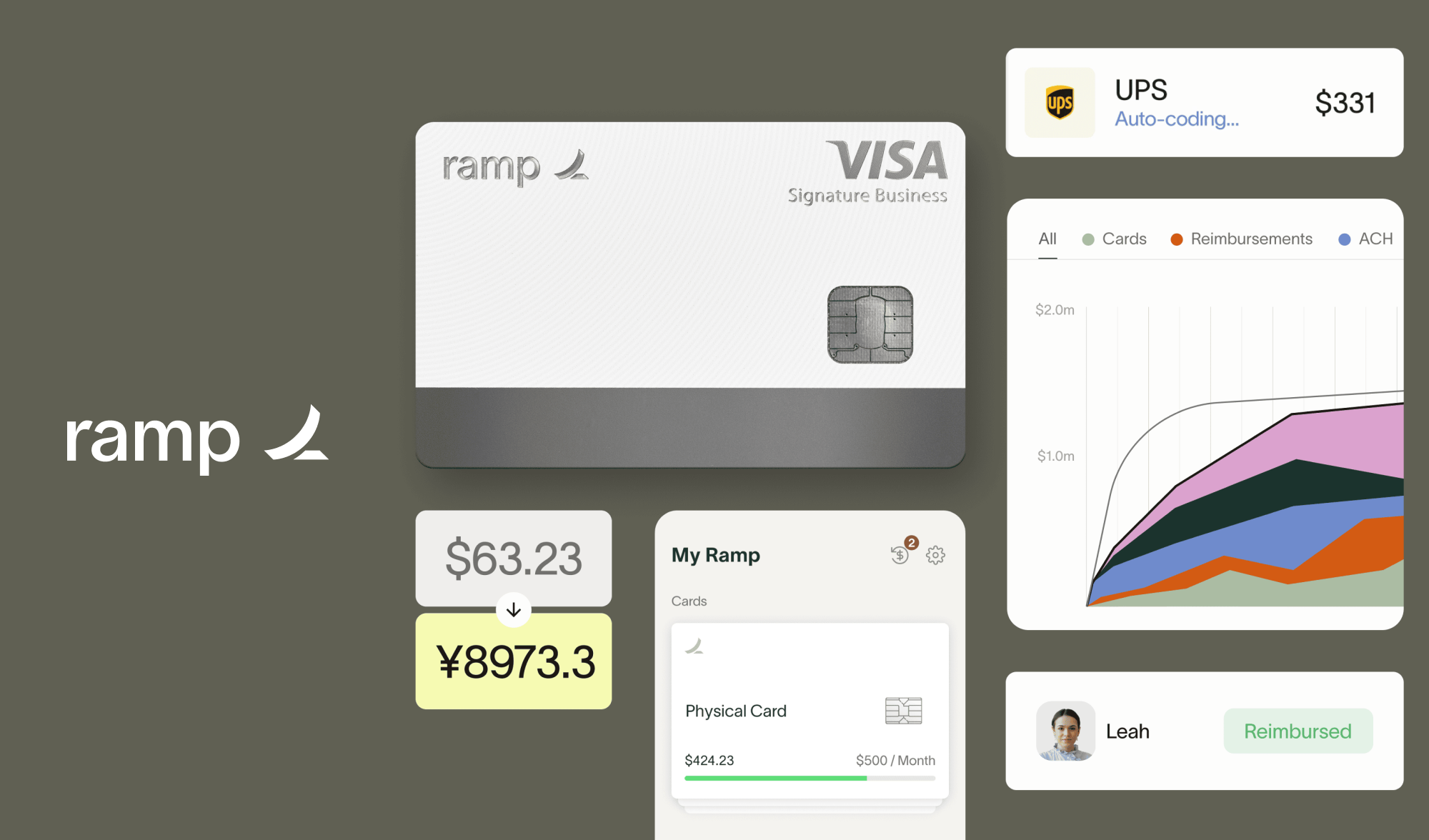

About Ramp At Ramp, we’re rethinking how modern finance teams function in the age of AI. We believe AI isn’t just the next big wave. It’s the new foundation for how business gets done. We’re investing in that future — and in the people bold enough to build it. Ramp is a financial operations platform designed to save companies time and money. Our all-in-one solution combines payments, corporate cards, vendor management, procurement, travel booking, and automated bookkeeping with built-in intelligence to maximize the impact of every dollar and hour spent. But we’re not just building features powered by AI. We’re building a platform where agents can chase receipts, close books, flag risks, and surface insights. This enables teams to reclaim their time and reinvest in what matters. More than 40,000 businesses, from family-owned farms to space startups, have saved $10B and 27.5M hours with Ramp. Founded in 2019, Ramp powers the fastest-growing corporate card and bill payment platform in America, and enables over $80 billion in purchases each year. Ramp’s investors include Thrive Capital, Sands Capital, General Catalyst, Founders Fund, Khosla Ventures, Sequoia Capital, Greylock, and Redpoint, among others, in addition to 100+ angel investors who have been founders or executives of leading companies. Ramp has been named to Fast Company’s Most Innovative Companies list and LinkedIn’s Top U.S. Startups for more than 3 years, as well as the Forbes Cloud 100, CNBC Disruptor 50, and TIME Magazine’s 100 Most Influential Companies. About the Role Ramp is seeking an experienced and entrepreneurial Transaction Monitoring & Sanctions Screening Program Manager to join our Compliance team. This pivotal role help uplevel, govern, and improve two critical components of our financial crime program in addition to other tooling initiatives. In this role, You will own the operational health, documentation, and governance of our transaction monitoring (TM) and sanctions screening systems—ensuring they are risk-based, scalable, auditable, and aligned with both regulatory and partner expectations, and help implement tools and observability dashboards for the Compliance organization. This role blends strategic oversight with hands-on program management. You’ll partner closely with Engineering, Data Science, Legal and Compliance to define requirements, oversee testing and tuning, and support investigations and reporting pipelines. You’ll also build observability metrics, help prepare for audits, and support related initiatives like dynamic risk ratings and due diligence flows. This is an ideal opportunity for a technically fluent compliance professional with a strong understanding of AML tooling, regulatory expectations, and cross-functional collaboration. What You'll Do Oversee the health and performance of Ramp’s transaction monitoring and sanctions screening systems, including rules, thresholds, workflows, and exception handling. Serve as a technical SME, partnering with Engineering and Data Science to evaluate system behavior and drive improvements. Maintain policies and documentation to meet regulatory expectations and follow existing guidance and best practices. Manage system governance processes, including rule tuning, model testing, validation coordination, and logic changes. Draft and maintain clear business requirements and testing plans for any logic or tooling updates. Use SQL and dashboarding tools to perform data analysis, track false positives, and improve rule precision. Support partner audit and regulatory exam preparation, including system documentation, policy walkthroughs, tuning history, and metric reporting. Establish operational KPIs and ensure reporting to internal stakeholders (e.g. Compliance leadership, Risk Committees). What You Need 6+ years of experience in AML/BSA compliance, financial crime systems, or compliance operations—preferably in fintech. Deep familiarity with transaction monitoring and sanctions screening programs and tools, including governance, logic design, and alert management. Strong understanding of regulatory frameworks Hands-on experience in testing, tuning, and documenting monitoring systems and alert thresholds. SQL proficiency Demonstrated ability to partner with engineering, product, data science and operational teams to translate compliance needs into tooling requirements and priorities. Strong written communication and documentation skills Comfort preparing materials for and engaging with financial partners, auditors and regulators. Nice to Haves Accreditation by ACAMS, an equivalent industry body, or other qualifications in the areas of financial crime, risk management, or compliance Experience with data design, internal tooling, or compliance systems implementation Prior ownership of partner or regulatory exam response processes Certifications such as CAMS or other relevant industry designations Benefits (for U.S.-based full-time employees) 100% medical, dental & vision insurance coverage for you Partially covered for your dependents One Medical annual membership 401k (including employer match on contributions made while employed by Ramp) Flexible PTO Fertility HRA (up to $5,000 per year) WFH stipend to support your home office needs Wellness stipend Parental Leave Relocation support to NYC or SF (as needed) Pet insurance Referral Instructions If you are being referred for the role, please contact that person to apply on your behalf. Other notices Pursuant to the San Francisco Fair Chance Ordinance, we will consider for employment qualified applicants with arrest and conviction records. Ramp Applicant Privacy Notice

This job posting was last updated on 9/17/2025